Atlas Honda Limited (ATLH) has reported an outstanding 75.2% year-on-year (YoY) increase in its profit after tax, reaching Rs. 10.65 billion for the nine months ending December 31, 2024. This is a significant jump from Rs. 6.08 billion in the same period last year, showcasing the company’s strong financial performance.

Sales and Profit Surge

Atlas Honda’s revenue surged by 27.2%, climbing to Rs. 146.86 billion compared to Rs. 115.42 billion in the previous year. This increase in sales contributed to an impressive 79.1% rise in gross profit, which reached Rs. 14.01 billion from Rs. 7.82 billion last year. The company’s gross profit margin improved as well, demonstrating enhanced operational efficiency and higher sales volumes.

Despite a 23.5% rise in the cost of sales, which totalled Rs. 132.84 billion, Atlas Honda’s revenue growth outpaced expenses, leading to improved profitability.

Operating & Other Financial Factors

The company saw an increase in operating expenses, with sales and marketing costs rising by 22.5% to Rs. 2.84 billion and administrative expenses growing by 24.1% to Rs. 799.71 million. However, this was counterbalanced by an 18.2% rise in other income, which reached Rs. 7.38 billion.

A remarkable 408.4% increase in the share of profit from an associate, reaching Rs. 41.43 million from Rs. 8.15 million last year, also contributed to overall earnings. Additionally, other operating expenses decreased by 11.7% to Rs. 662.86 million

Although finance costs rose by 55.7% due to higher interest rates, Atlas Honda’s strong sales and additional income helped absorb these expenses.

The company paid Rs. 6.10 billion in taxes, marking a 57.2% increase from Rs. 3.88 billion last year. Given the impressive financial performance, the Board of Directors has proposed a dividend payout, further strengthening Atlas Honda’s position in the market.

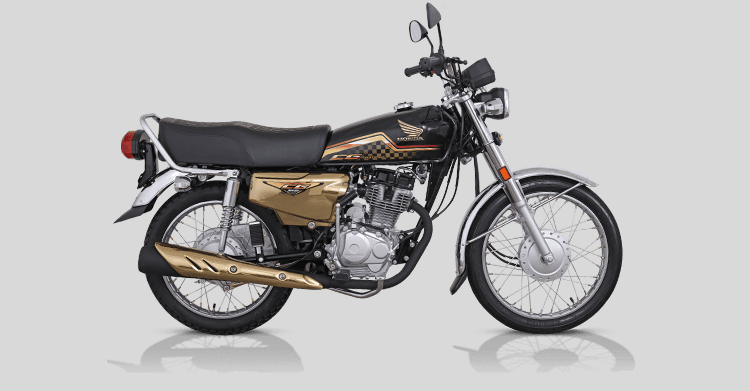

With steady growth and strong profitability, Atlas Honda continues to solidify its reputation as a market leader in the motorcycle industry.

0 Comments

Post Comment